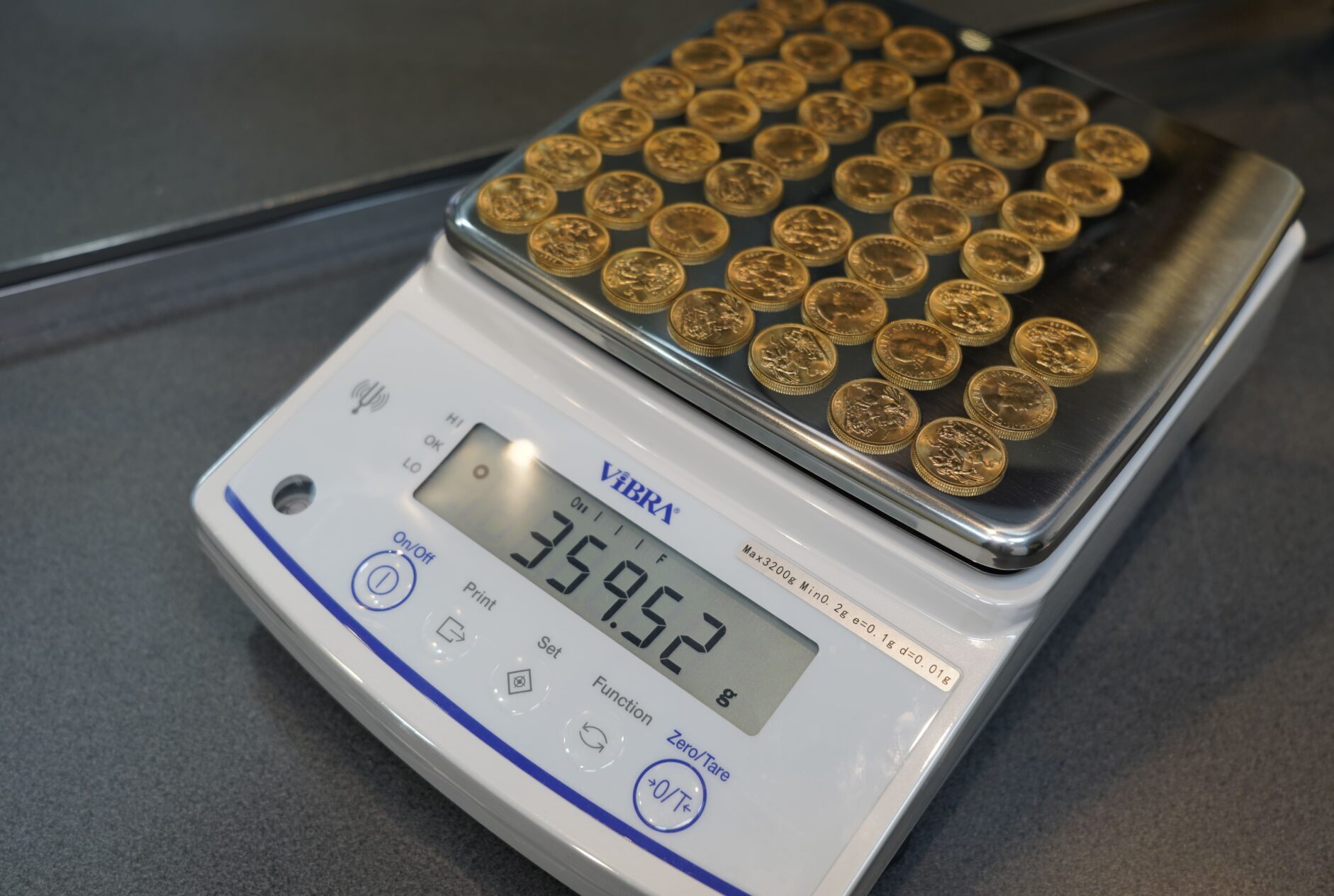

A close-up of a digital scale displaying a weight of 359.52 grams, with multiple gold coins evenly arranged on the scale’s surface.

With the rising value of gold, it is imperative for New Zealanders and individuals worldwide to seriously consider selling their gold assets now. The current market dynamics are exceptionally favorable, making a compelling case for immediate action.

Demand for gold is not just increasing; it’s on a clear upward trajectory due to factors like economic uncertainty and inflation hedging. Meanwhile, production levels have hit historic lows, creating a supply-demand imbalance that drives prices even higher. This unique situation strongly indicates that the price of this precious metal will continue to rise in the foreseeable future. For sellers, this isn’t just an opportunity—it’s potentially a lucrative one.

Capitalizing on your investments while market conditions are optimal could lead to significant financial gains. Furthermore, as countries face economic instability and geopolitical tensions, gold remains a safe haven asset that investors turn to during turbulent times.

If you’ve been contemplating whether now is the right time to sell gold in New Zealand, consider this: aligning with these favorable market trends can maximize your returns and secure your financial future. Seizing this moment could be one of the smartest decisions you make in today’s unpredictable economic landscape.

Essential Tips On How To Sell Gold In New Zealand

Selling your gold doesn’t have to be overwhelming. With a clear understanding of the process, you can confidently maximize the value of your precious metal. The key is to take it step by step: start by identifying the type of gold you own, determine its purity, research current market prices, and factor in broader economic trends.

This guide breaks down the process into straightforward, actionable steps, empowering you to navigate the complexities of selling gold in New Zealand with ease and success. Whether you’re a first-time seller or looking to refine your approach, this article will help you unlock the full potential of your gold assets.

1. Why Are People Selling Their Gold Today?

Gold has always carried a certain mystique—a symbol of wealth, security, and timeless elegance. But there’s something to be said for understanding when to let go of it. With gold prices soaring, now might be the perfect time to turn those tucked-away treasures into tangible opportunities.

Think about it: How many of us have old jewelry, coins, or heirlooms gathering dust in a drawer, more sentimental than practical? Sure, it feels safe to hold onto them, especially in uncertain times. But what if those pieces could do more than sit idle? Selling gold at its peak value is a chance to turn stagnant assets into something dynamic—cash that can pay off a debt, fund a dream, or create memories that shine brighter than any necklace ever could.

It’s not just a financial move; it’s a mindset shift. Decluttering your space and redistributing your wealth feels oddly empowering, like taking control of your resources in a way that aligns with your goals. Selling gold isn’t about losing something valuable—it’s about rediscovering its value in a new form, one that works for you in the here and now.

2. Is Now The Perfect Time To Sell Gold?

In today’s rollercoaster of a market, deciding whether to sell your precious metals is no small task—it’s all about timing and strategy. Before making a move, it’s worth taking a step back to consider a few critical factors.

Start with the basics: supply and demand. When demand for gold is high and supply is tight, prices skyrocket. On the flip side, if there’s too much gold circulating and not enough buyers, prices tend to dip. Simple enough, right? But there’s more to the story.

Economic signals also play a huge role. Think about inflation, currency strength, and interest rates—they all ripple through the gold market. Historically, when the economy feels shaky, people gravitate toward gold as a safe haven, often driving its value up. Right now, as of January 2025, gold is sitting near an all-time high of $2,650 per ounce. That’s a number worth paying attention to, especially if you’re in New Zealand or anywhere else where selling at the peak could turn your metals into a financial win.

The key takeaway? This could be your golden moment—literally. Evaluating these factors can help you make an informed decision and ensure you get the most out of your investment.

3. What Type Of Gold Can You Sell?

Before selling your gold, it’s important to understand the different forms it takes—each with its own unique value and appeal. Here’s a breakdown to help you get the most out of your precious metals:

Gold Jewelry

From delicate chains to bold statement pieces, gold jewelry is a blend of personal expression and tangible value. Chains, in particular, are a wardrobe staple—versatile enough to wear solo for a minimalist vibe or layered for added drama. The key to understanding gold jewelry lies in its karat:

- 10K, 14K, 18K—these numbers reveal the gold’s purity.

- Higher karats (like 18K) boast a richer, more lustrous hue but are softer due to their higher pure gold content.

- Lower karats (10K or 14K) are stronger and more durable, thanks to the added alloys, but they carry less intrinsic gold value.

Knowing these differences helps you make informed decisions about the worth of your pieces—both in beauty and in market value.

Gold Coins

Gold coins are prized not just for their beauty but for their significant metal content, which makes them highly valuable and versatile. Often made from high-purity gold, they appeal to collectors, investors, and industries alike. What makes them so attractive?

- Their quality and purity levels are exceptional.

- Coins are easy to store, transport, and sell, making them a practical choice for those looking to recycle or cash in on their investments.

Gold Bullion

Gold bars or ingots are the crown jewels of gold investing. They’re a favorite for savvy investors, offering unmatched value and a clear link between weight, purity, and market price. Why do investors love bullion?

- It’s an ideal hedge against inflation and economic instability.

- Beyond its intrinsic worth, owning bullion represents financial strategy and long-term planning.

Purity is Key

No matter the form—jewelry, coins, or bullion—gold’s purity directly impacts its value. Higher purity means higher profit when selling, as it reflects both quality and market demand. Understanding this is essential for anyone navigating the world of gold trading or investing.

Every piece of gold tells a story. By recognizing its form and purity, you’re better equipped to unlock its full potential—whether you’re selling, collecting, or planning for the future.

4. How Is Your Gold’s Value Determined?

The karat system is the ultimate guide to understanding the true value of your gold. It’s a straightforward way to measure how much pure gold is in a piece compared to other metals like copper or silver.

At the top of the scale is 24 karats, representing nearly pure gold (99.9%). As the karat number decreases, more alloys are mixed in, altering the gold’s purity, color, and strength. Here’s a quick breakdown:

- 10K: Around 41.7% gold—durable but lower in purity.

- 14K: About 58.3% gold—a popular balance of richness and durability.

- 18K: Approximately 75% gold—luxurious with a deeper golden hue.

- 24K: The purest form, with stunning brilliance and intrinsic value.

The higher the karat, the more pure gold in the piece, and the more valuable it is. For example, a 24K gold ring will always outshine an 18K one in terms of raw gold content and market value. That extra purity doesn’t just boost the price—it also makes the piece more desirable to collectors and investors alike.

Knowing these distinctions is powerful. It equips you to make smart decisions when you sell gold in New Zealand, ensuring you receive a fair return. Whether you’re dealing with jewelry, coins, or bullion, understanding the nuances of gold purity is essential for navigating the market with confidence. After all, gold isn’t just about beauty—it’s about knowing its worth.

5. Should You Sell Your Gold Online Or In-Store?

When it comes to selling gold, the method you choose can make a big difference in your experience and the payout you receive. Let’s break it down so you can decide what works best for your needs.

Traditional Methods: Local Jewelers & Pawn Shops

Heading to a local jeweler or pawn shop is a tried-and-true option, especially if you’re looking for quick cash. The process is straightforward: walk in, get your items appraised, and walk out with money in hand. No shipping, no waiting, no fuss.

But there’s a trade-off—these buyers typically offer lower prices to account for their overhead costs and profit margins. If speed and simplicity are your top priorities, this might be your best bet, but don’t expect top dollar.

Selling Gold Online

If maximizing your return is your goal, selling gold online is a strong contender. Here’s why:

- Better Rates: Online buyers often have lower overhead costs, which translates to higher offers for you.

- Convenience: You can compare multiple offers, check market trends, and finalize sales—all from the comfort of your home.

- Peace of Mind: Fully insured shipping protects your items during transit.

However, it’s not without its challenges. There’s no face-to-face interaction, which can feel impersonal and might leave you questioning trustworthiness. Plus, the lack of immediate cash means you’ll need to wait for payment.

Selling Gold at Pawn Shops

Pawn shops are ideal if you need cash quickly and prefer a personal touch. Their appraisal process is fast and straightforward, giving you a clear sense of your item’s worth on the spot. And because you’re dealing face-to-face, there’s room for negotiation—something that online platforms can’t offer.

On the downside, pawn shops also account for their own profit margins, which might mean a lower payout than online options. Still, the immediacy and personal interaction often outweigh the potential drawbacks, especially when time is of the essence.

Which Option is Right for You?

If speed and simplicity are your priorities, local jewelers or pawn shops are the way to go. If you’re focused on maximizing profit and have the time to shop around, the online route offers the best potential return. Either way, the key is knowing your priorities and weighing the trade-offs to make the most of your gold-selling experience.

A combined storefront in New Zealand with ‘EZ Cash’ offering gold-selling and loan services, and ‘The Coffee Club’ providing café seating. A sign outside EZ Cash promotes ‘Cash for Gold’ in any condition, targeting customers looking to sell gold in NZ.

6. What Should You Look For In A Reputable Gold Buyer?

When choosing a gold buyer, transparency should be your guiding star. A trustworthy buyer will take the time to explain their appraisal process, breaking down how they assess your gold’s purity and weight. They’ll also base their offers on up-to-date market rates, ensuring you get a fair and competitive price. Look for buyers who offer free, no-strings-attached appraisals—a clear sign they value trust and professionalism over pushy sales tactics.

Consistency is another hallmark of a reliable buyer. They should provide upfront pricing with no hidden fees, so you’re never left wondering how much of your gold’s value is being siphoned away.

Reputation matters, too. A buyer with glowing reviews and testimonials is more likely to treat you and your valuables with care and respect. Whether you’re selling in person or online, make sure they use secure, certified methods for handling your items. Features like tamper-proof packaging and insurance for mailed gold add an extra layer of protection and peace of mind.

Ultimately, the right gold buyer will make the process feel safe, transparent, and straightforward, leaving you confident that you’ve received the best possible value for your treasures.

7. How Do You Prepare Gold For Selling?

Before taking your gold to a buyer, a little preparation can go a long way in maximizing its value. Taking the time to organize and present your items thoughtfully can make the process smoother and more rewarding.

Start by giving your gold a gentle cleaning. Use a soft cloth to remove dirt and restore its shine, but steer clear of harsh chemicals or abrasive materials—they can damage the surface and dull the metal’s natural luster.

Next, sort your pieces by their karat value. Separating them into groups based on purity (10K, 14K, 18K, etc.) makes it easier for the appraiser to evaluate your gold accurately. A little organization on your end can lead to a more efficient assessment and potentially a better offer.

Don’t forget the paperwork! If you have receipts, certificates of authenticity, or previous appraisals, bring them along. These documents verify the quality and origin of your gold, providing an extra layer of credibility and helping to back up its value.

Finally, take a moment to research current gold market rates. Knowing the latest trends and prices will give you confidence when negotiating and ensure you’re getting a fair deal.

By cleaning, categorizing, gathering documentation, and staying informed, you’ll walk into the sale prepared and empowered—ready to secure the best possible value for your cherished items.

8. What Are The Common Mistakes In Selling Gold?

Selling your gold might feel like a straightforward task, but rushing into it can lead to regret. To get the most out of your valuables—and to avoid potential pitfalls—it’s essential to approach the process with care and strategy. Taking the time to research, plan, and understand the nuances of the market can make all the difference, ensuring you walk away with a deal that respects the true value of your gold. Here’s how to avoid common mistakes and sell smart.

Don’t Rush the Sale

When you’re in a hurry, it’s easy to make costly decisions. The allure of quick cash can be tempting, but accepting the first offer or rushing into a deal often means settling for less than your gold is worth. Slow down. Evaluate your items carefully, and shop around to gather multiple offers from different buyers. Think of this as more than a transaction—it’s your opportunity to advocate for the value of your asset. Patience isn’t just a virtue here; it’s a financial strategy that can significantly boost your return.

Say “No” to the First Offer

One of the biggest mistakes sellers make is jumping at the first price they’re quoted, especially without understanding current market conditions. Gold prices fluctuate, and without knowing the going rate, you could unknowingly accept a lowball offer. A little research goes a long way—check the current market price and compare it against the bids you receive. Armed with this knowledge, you’ll be able to spot an unfair deal from a mile away and negotiate with confidence.

Know What You’re Selling

Gold isn’t just gold—it’s an asset with unique traits that influence its value. Is it pure gold, or is it mixed with other metals? Does it have historical or artistic value? Knowing these details helps you recognize the true worth of your items. Gather any paperwork you have—appraisals, certificates, or receipts—and be ready to highlight what makes your gold special. This information is not just helpful; it’s your leverage in securing a fair deal.

Protect Yourself During Transactions

If you’re selling online, prioritize safety and security at every step. Always insist on insured courier services to safeguard your gold during transit—this extra layer of protection can save you from devastating losses. Work with buyers who are upfront about their appraisal process and are willing to walk you through their methods. Transparency builds trust, and it ensures you’re not left guessing how they arrived at their offer.

Additionally, reputable buyers use advanced testing equipment to assess your gold accurately, so look for those who meet this standard. Be wary of hidden fees or vague pricing structures, and don’t be afraid to ask for clarity. When you insist on fair and open practices, you protect yourself from exploitation and ensure a smoother transaction.

9. Selling Your Gold Can Be A Stress-Free Experience

Selling your treasured gold can and should be a smooth, reassuring process—one that honors both its monetary and emotional value. These pieces aren’t just metal; they’re tangible stories, markers of life’s most meaningful moments, and connections to the past. Whether it’s a family heirloom that’s been lovingly passed down or a piece that commemorates a milestone, parting with gold often carries a weight that goes beyond its weight in grams.

The best gold buyers understand this delicate balance. They don’t just see the material; they see the memories. That’s why many reputable buyers have streamlined their processes to make selling as stress-free as possible. Imagine walking into a trusted buyer’s store, gold in hand, and leaving with cash in your pocket moments later. No endless waiting, no drawn-out negotiations—just immediate compensation that reflects the true worth of your item. It’s a transaction grounded in respect for your time and your treasures.

Even better, many buyers now offer free, no-appointment-needed appraisals, either in person or online. This flexibility means you can explore your options without the burden of fees or rigid scheduling. You can walk in on your own terms, have your gold evaluated by experts, and feel confident in the transparency of the process. It’s a small but significant touch that transforms what could be a nerve-wracking experience into something refreshingly simple.

Selling your gold doesn’t have to feel like a gamble. With the right buyer, you’re not just exchanging metal for money; you’re turning meaningful possessions into tangible value—efficiently, respectfully, and without unnecessary hassle. Take the leap, and let those cherished items start their next chapter while rewarding you for the memories they’ve carried.

10. Where Do You Start Exploring Options?

Wherever you are in New Zealand—whether in bustling Auckland or the serene countryside—selling your gold has never been easier. Modern solutions like free mail-in services have revolutionized the process, offering an accessible, hassle-free way to turn your valuables into cash without ever leaving your home.

These services prioritize your peace of mind with fully insured courier options, ensuring your gold is safe throughout its journey. Once your items arrive, reputable buyers provide secure appraisals and quickly make an offer. If you accept, payment is processed immediately via direct transfer or cash, saving you time and effort. Say goodbye to the need for in-person visits to pawn shops or jewelers—this innovative method is perfectly tailored to today’s fast-paced lifestyles, blending security, convenience, and efficiency.

Why Cash For Gold Stands Out

Cash for Gold has earned its reputation as Auckland’s top gold buyer and a trusted name across New Zealand. Our mission is simple: to offer a seamless and transparent gold-selling experience that prioritizes your satisfaction. Whether you’re parting with old jewelry, bullion, or rare coins, we’re here to make the process straightforward, reliable, and rewarding.

Transparent Pricing

We believe in clarity every step of the way. Our pricing is not only fair but completely transparent, with no hidden fees or surprises. Rates are prominently displayed online, so you can make an informed decision with confidence. This dedication to openness fosters trust and underscores our commitment to serving every customer with integrity.

Convenience at Its Best

Selling your gold shouldn’t feel like a chore. At our Auckland store, there’s no need to schedule an appointment—just walk in and leave with cash in hand. With immediate payouts of up to $10,000, we’ve streamlined the process to ensure you get what you need, fast and hassle-free.

For those outside Auckland, our mail pack service is designed to bring the same level of ease and efficiency right to your doorstep. Wherever you are in New Zealand, our nationwide coverage guarantees a risk-free and smooth experience from start to finish.

Cutting-Edge Accuracy

Your gold deserves a precise and professional evaluation, which is why we use state-of-the-art XRF (X-ray fluorescence) technology to determine its purity and weight. This advanced equipment ensures unparalleled accuracy and allows us to complete assessments swiftly, so you can move forward with confidence. Plus, all appraisals are free, giving you peace of mind without any financial commitment.

Customer-First Approach

At Cash for Gold, you’re more than a transaction—you’re a valued client. From our transparent pricing to our free appraisals and instant payouts, every part of our process is designed with your needs in mind. We know that selling gold can feel daunting, especially when the pieces hold sentimental value. That’s why we’ve built a service you can trust to handle your treasures with care, respect, and professionalism.

Nationwide Accessibility

Whether you’re in Auckland or the farthest reaches of New Zealand, our services are tailored to meet your needs. With our secure mail-in option, selling gold remotely is just as effortless as visiting our store. Every step of the process, from packaging to payment, is handled with meticulous care, ensuring a seamless experience no matter where you’re located.

A Gold-Selling Experience You Can Trust

We understand that parting with gold isn’t just a financial transaction; it’s an emotional one. That’s why our approach combines cutting-edge technology, transparent practices, and a deep commitment to customer satisfaction. When you choose Cash for Gold, you’re choosing a partner who values your trust and works tirelessly to deliver a stress-free, rewarding experience.

Let us help you transform your gold into immediate financial freedom—securely, confidently, and with complete peace of mind.

Take The First Step To Selling Your Gold

Selling gold in New Zealand can be both simple and rewarding when approached with the right strategy. Understanding key factors like current market trends and the purity of your gold is essential to maximizing returns. Gold prices fluctuate daily, so staying informed empowers you to time your sale for the best possible outcome. Whether it’s old jewelry or bullion, knowing your items’ worth ensures you approach the process confidently.

Choosing the right selling method is equally important. If you’re in Auckland, visiting a reputable in-store buyer offers immediate cash and personalized service. For those elsewhere in New Zealand, free mail-in services provide a secure and convenient alternative, with insured shipping and fast appraisals. No matter your location, there’s a tailored solution to meet your needs, making the process seamless and secure.

Ready to turn your unused gold into cash? Visit our Auckland CBD store for expert guidance and instant payouts. If you’re outside the city, request a free mail pack to discover your gold’s value without hassle or obligation. By partnering with a trusted buyer, you can confidently transform dormant assets into valuable cash today.