1. Supply and Demand Dynamics

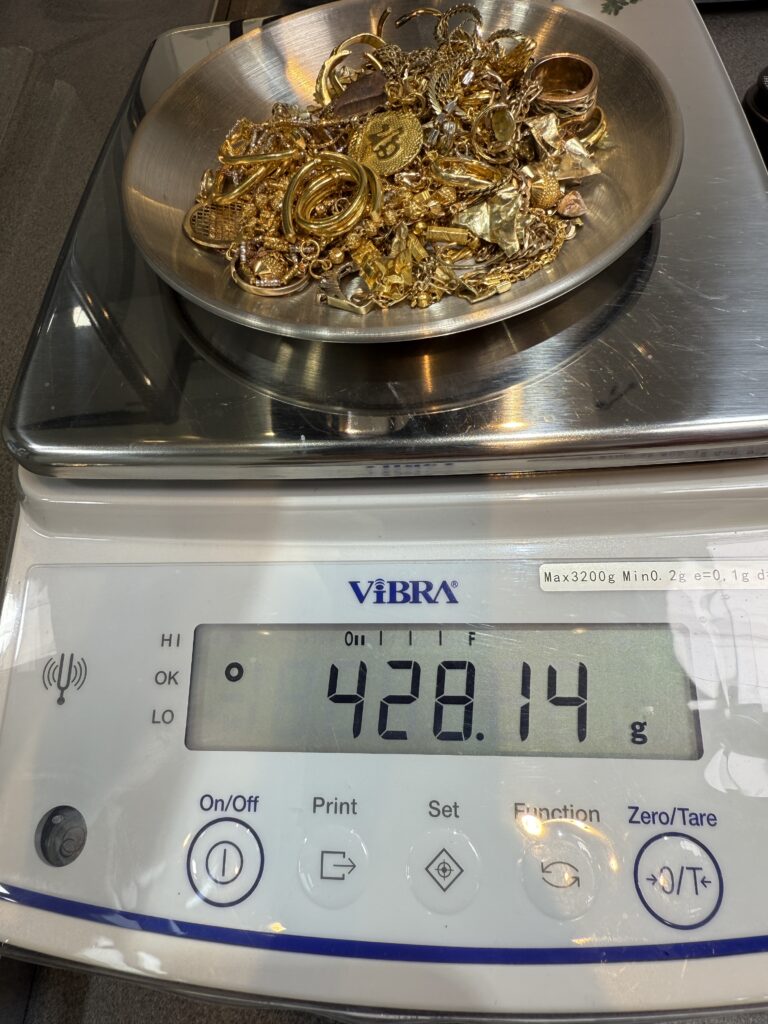

The supply of gold is limited and comes mostly from recycling and mining. Gold prices are often driven higher by a limited supply and an increasing demand. Jewelry production and industries that require fuel are also investment opportunities.

2. Global Economic Uncertainty

Gold is often seen as an investment “safe-haven” during economic recessions or times of uncertainty. Gold prices can rise during market declines as gold becomes an attractive, secure investment.

3. Inflation rates

Gold is a good hedge against inflation. Gold becomes more valuable when inflation increases. Gold is a good choice in inflationary times because of this direct correlation.

4. Central Bank Policies

A significant amount of gold is held by central banks. The decisions they make regarding gold buying and selling can have a direct impact on the price of gold. Gold’s value can often increase when central banks store gold due to increased demand.

5. Interest Rates

Gold does not pay interest or distribute dividends, unlike bonds and savings accounts. Gold becomes a more attractive alternative when rates of interest are low. Investors buy gold through online channels or other methods to protect their wealth.

6. US Dollar Strength

The US dollar has an opposite relationship to gold prices. Gold prices increase when the US dollar falls, as it becomes cheaper in other currencies. The sudden changes in gold prices are often due to this factor.

7. Geopolitical events

Investors often seek out safe investments in times of political instability, international conflict, or war. Gold prices can rise when there is uncertainty in the stock market.

8. Price of Oil

The two are frequently interconnected. Gold prices that are rising usually lead to inflation which in turn increases the demand for gold. In the opposite direction, falling prices of oil gold may temporarily reduce gold demand.

9. Industrial Use

Not only is gold a good investment, but it also has a vital role to play in many industries. The increased industrial usage impacts gold price factors by changing demand patterns.

10. Gold Spread

The difference in gold prices between buying and selling, also known as the spread,, can affect gold’s value. The spread can influence the value of gold. A wider spread may discourage small investors while a smaller spread will encourage buyers.

Understanding Gold Investments

If you are planning to invest in Gold, it is important that you understand these key factors.

Popular options for you to think about:

Gold Coins

Due to their historical and portable value, gold coins are very popular. Gold coins are popular amongst collectors as well as investors for their diversification.

Gold Coins 1 Ounce

1 ounce gold coins, which are available in standard sizes and offer an entry-level investment into gold for investors who want to invest easily, provide a convenient option. The coins can be used to track the price of gold.

Gold Bars

Gold bars are a popular choice for investors who want to invest in large quantities. Gold bars are a good way to store large quantities of gold, even though the price may fluctuate based on current market conditions.

How can I buy gold online?

Due to the convenience, today many investors choose to purchase gold online. You can get real-time updates on prices online, which will help you to find the best deals. When buying gold, do your research and only buy from reputable dealers.

A timeless asset: Gold.

Since centuries, the price of gold has remained constant. Gold’s price is influenced by factors such as demand, central bank policies, and economic conditions. However, it remains a popular symbol for wealth and security.

The gold market is one of the safest and most reliable investments. Cash for Gold is the top metal dealer in New Zealand. They can help you make better investment decisions by helping you understand what influences gold prices.

Watch market trends, economic indicators, and geopolitical factors in order to get the most out of this asset. Gold bars or coins are a great addition to your portfolio.