What is more secure?

When building wealth, choosing the best investment is essential. Investors have two options that are both popular and yet very different: gold or cryptocurrency. While gold represents tradition and stability, cryptocurrency is innovative and has a high potential for risk and reward. Your goals, your risk tolerance and understanding of the market will determine which you choose. We’ll compare the risks and benefits of gold investing vs. cryptocurrency by following the words.

A Timeless Investment

Since thousands of years, gold has served as a store of value. Gold’s resilience to market crises and downturns is a major attraction for conservative investors.

Gold Investment Benefits

- Reliability and Stability:Gold’s prices fluctuate much less than those of other assets including cryptocurrency. Gold is a safe haven in times of market turmoil.

- Gold Inflation Hedging:When the inflation rate increases, gold’s value often rises and maintains its purchasing power.

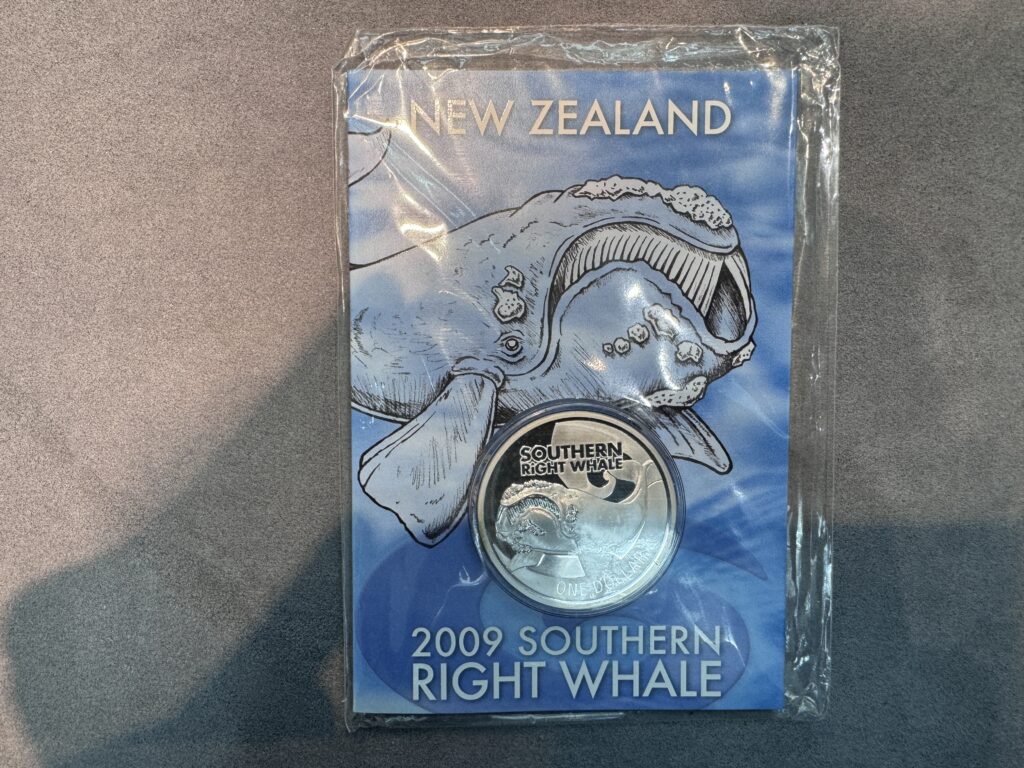

- You can buy gold bars or coins and wear jewelry to hold gold as a tangible asset.

How to invest in gold

You can include gold in several different ways:

- The traditional way to invest in gold is by purchasing it directly from dealers.

- Well! Gold can be gained by investing in gold mining or refining companies.

- You can invest in gold through exchange-traded fund (ETFs), even if you don’t own it.

You can protect yourself from scams by knowing how to invest!

Important Considerations

- Check the spot price before buying. Find the spot gold price at reliable dealers and online platforms.

- Storing gold safely can be expensive, particularly for large amounts.

- The gold is easily convertible into money when required.

The Future of Finance: Cryptocurrency

Blockchain technology is used to secure digital currency. Decentralized means it’s not controlled by the government or financial institutions. Due to the potential of high returns, cryptocurrencies like Bitcoin, Ethereum and others are gaining massive popularity.

The Benefits of Cryptocurrency Investment

- Cryptocurrencies are a high growth potential. These currencies have provided exponential returns in a short time, which makes them attractive to investors who want high risk, high reward.

- Accessibility Anyone can invest in crypto through online platforms. Options start at just a few dollars.

- InnovationBlockchain Technology offers security and transparency beyond currency. Smart contracts and NFTs are examples of this.

How To Invest In Cryptocurrency

These points will help you get going with investing.

- Purchase popular altcoins or Bitcoins.Platforms such as Binance and Coinbase allow you to do so.

- Crypto StakingSome cryptocurrency allow you to earn passive income through staking your coins on a blockchain.

- Trading:Many traders trade cryptocurrency based on the market fluctuation for short-term gain.

Important Considerations

- Cryptocurrencies can be extremely volatile. Prices can rise or fall dramatically within a few hours.

- Many governments are trying to figure out the best way to regulate cryptocurrency, and this could have an impact on its value.

- When investing in crypto, be sure to check if the wallets are secure and prevent hackers.

A head-to-head comparison of gold and cryptocurrency

A detailed comparison can help you decide whether to invest in gold or cryptocurrency.

Factors which could impact:

1. Stability

- Gold:Stable, reliable and less volatile.

- Bitcoin: Highly volatile, prices are subject to dramatic fluctuations.

2. Growth Potential

- Gold: Moderate growth over time.

- Bitcoin: High potential but high risks.

3. Liquidity

- Gold:Very liquid, easy to sell.

- Cryptocurrency: Liquid, but depends on exchange platforms.

4. The Inflation Hedging

- Gold: Excellent hedge against inflation.

- Cryptocurrency: Limited data; still uncertain.

5. Ownership

- Gold:Physical Asset that you can hold and store.

- Digital Assets: Digital assets that can be stored online or in offline wallets.

6. Accessibility

- Gold:Requires physical means to purchase gold at the spot price, or broker assistance.

- Bitcoin:Easy online purchase with minimum investment.

Should you choose gold?

If:

- You are looking for low-risk investment in gold.

- Your goal is to protect yourself from inflation.

- Your portfolio needs to be diversified with tangible assets.

Why Should you choose cryptocurrency?

Cryptocurrency might suit you if:

- You are comfortable with volatility and high risks.

- Your goal is to achieve high growth in a relatively short period of time.

- Blockchain technology is the future you believe.

Combine both for a balanced portfolio?

Consider investing in both gold and cryptocurrency instead of just one to create a balanced portfolio.

How?

- Stability with Gold: Allocate some of your money to gold in order to achieve stability and value over the long term.

- Crypto For Growth:Use smaller portions of cryptocurrency to achieve high potential returns.

- Review Regularly: Monitor both investments to adapt your strategy according to market conditions.

What is better? What is better? Gold or cryptocurrency?

Well! Your personal investment preferences and strategy will determine your decision. It is the best choice for long-term preservation of wealth. Cryptocurrency is a good option for people who are willing to risk a lot for the potential of high rewards.

Do you have any experience investing in cryptocurrency vs gold? Start small with Cash for Gold and gradually build up your knowledge.

Why not combine both stability and innovation when investing?