In recent years, Bitcoin and Gold have become popular investment options. Bitcoin is seen as the electronic equivalent to gold. Both assets are a hedge for economic instabilities.

Well! There are many options to turn your Bitcoins into gold. This article will guide you on how to sell Bitcoin for solid gold. It includes tips and tricks.

Learn how to buy bitcoin with gold to avoid making any mistakes in the future.

Why convert Bitcoin into Gold

Understanding why people might convert Bitcoin into gold is important before we get to the “how” and “why”.

- Gold’s stability:Gold is a stable metal with a long-term track record.

- Gold as an inflation hedge:Gold is used by many to protect themselves from rising prices, by decreasing its value.

- Diversification Large amounts of Bitcoin used to convert into gold help diversify investment portfolios.

- Tangible asset:Gold can be held in your hands, as opposed to Bitcoin which is only available digitally.

A Guide to Buying Bitcoins for Gold

1. Select a Trusted Dealer of Gold

Selecting a trustworthy dealer is the first step in selling Bitcoin for gold. You must choose a dealer that specializes in Bitcoin transactions.

- Research: Look for dealer ratings and testimonials, as well as online reviews.

- Verify the Bitcoin/gold exchange rates:The Bitcoin/gold exchange rates vary depending on fluctuations in the market, so check before you make a purchase.

- Check credentials:Verify the dealer’s certifications.

2. Decide what type of gold you want to buy

You must choose the form of gold that you wish to purchase when converting Bitcoin into gold.

Common options include:

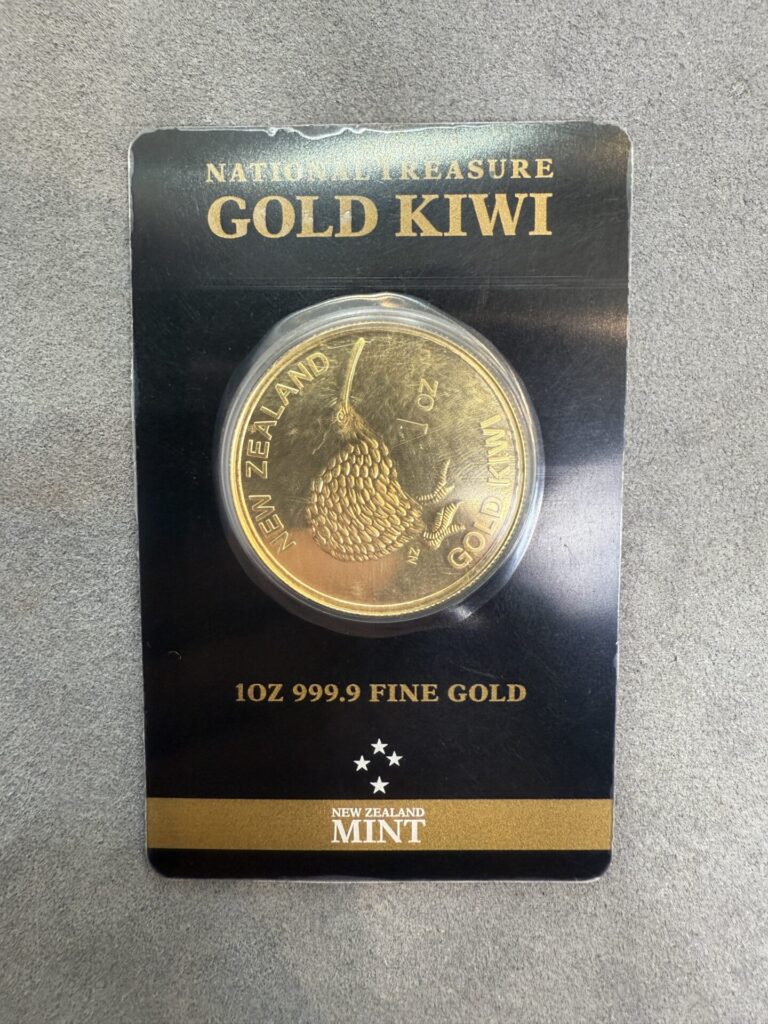

- Gold Coins include: American Gold Eagle, Krugerrand and Gold Coins. In the future, coins will be easier to purchase.

- Bars of Gold:Bars make a good option for large investments. This is a good option for larger investors due to the lower premiums.

- Bullion Gold: Bullion gold includes both coins and bars, and is the most common form of investment in gold.

You should know which forms are best for holding long term, and which are easiest to sell.

3. Understanding the Bitcoin Gold Exchange rate

Exchange rates are important to take into consideration. Gold and Bitcoin are subject to fluctuations. It is important to secure a favorable rate of exchange before you convert.

- Bitcoin volatility:Bitcoin’s value may change drastically in a very short time. Check the current exchange rate in real time before you commit to any transaction.

- Timing the Market:To maximise your returns, you should sell Bitcoin at a time when it is valued high in comparison to gold. You will get more gold in exchange for your Bitcoin.

4. How to Setup a Cryptocurrency Wallet

You’ll also need to have a wallet for storing your bitcoins before selling them. When you exchange, your Bitcoin will be transferred from the wallet of the gold dealer to this wallet.

- Hot wallet: Online or app-based wallets with easy access. They are, however, more susceptible to hackers.

- Cold wallet: Hardware-based wallets provide extra security because they are stored offsite.

Before making any purchases, make sure your wallet is safe.

5. Complete the transaction

It’s time to complete the exchange once you have chosen your dealer and reached an agreement on the Bitcoin Gold rate.

The following are the steps that you will need to take:

- Send Bitcoin to the Gold Dealer’s Wallet:Send an agreed amount of bitcoin to the gold seller’s wallet.

- Secure the price: Ensure that the gold and exchange rates are fixed before you transfer Bitcoin.

- Get your gold: Once the dealer has received your Bitcoins, they will send it to you.

How to buy gold with Bitcoin

- Gold Online Dealers:Some dealers will accept Bitcoin.

- Bitcoin exchanges: Cryptocurrency exchanges provide gold-backed tokens and other ways to exchange Bitcoin directly for gold.

- Marketplaces for peer-to-peer trading: Sites such as LocalBitcoins and Paxful let you find people who are willing to exchange gold in return for Bitcoin. Verify the peer-to-peer sellers’ reputation.

How to Sell Bitcoins for Gold

Consider the following suggestions to ensure a seamless experience when you sell Bitcoins for gold:

- Timing is important. Watch the trends in both Bitcoin and Gold.

- Coin clipping is a fraud that involves shaving off small amounts of the gold from coins.

- Safe Storage:Once your gold is received, you should store it safely in a vault or safe. Keep large quantities of gold away from unsecured areas.

The Pros and cons of converting Bitcoin into Gold

Pros:

- Tangible asset:Gold can be stored and kept.

- Less volatility:Gold’s price movement is generally less volatile than Bitcoin’s.

- History:Gold is a valuable investment that has been around for many centuries.

Cons:

- Liquidity Bitcoin is easier to buy and sell than gold.

- Additional Storage Charges: Keeping gold safe often involves additional charges for vaults or sales.

- Transaction fees: Some dealers charge higher transaction fees, which can reduce your returns.

The Most Expensive Coins You Should Look for

If you are investing in collectible or rare gold coins be ready for higher prices. The most valuable gold coins are:

- Valued at more than $7 million, the 1933 Double Eagle is

- A 1907 Saint-Gaudens double eagle: This is a valuable piece of art because it has incredibly intricate details and carries hefty historical significance.

The gold in these collectibles is worth a lot, but their rarity also adds value.

Selling Bitcoins for Gold is an excellent way to diversify investments. By following the guidelines in this article and using the provided tips, you will be able to maximize your return and convert your digital assets safely into long-term, tangible investments such as gold. Choose a reputable dealer like Cash for Gold. who will help you understand exchange rates, and safely store your gold.

You can safeguard your assets from the volatile digital currencies, and market uncertainty by converting Bitcoin to a gold-like asset.