As an investor you may have kept some money in gold or other precious metals. It protects against the possible losses that equities could incur in a declining economic trend. It has worked and continues to work, but an alternative strategy threatens to undermine this proven capital preservation method. Bitcoin is a popular asset among investors because of its long-term nature, the ability to gain support and fame, as well as its exciting patterns.

Although gold and crypto currencies are often compared, a tangible gold asset is different from a digital currency that’s intangible. Gold’s supply and demand are much more diverse. Even during times of rising inflation, gold has proven to be a safe investment. Gold is unlike any other investment because of its many uses. Gold is acquired by central banks and investors to protect their assets and earn returns. Many modern products such as TVs and mobile phones rely on gold. The price of gold can last longer than many other assets due to its multiple applications. When the markets are insecure, investors purchase gold to protect themselves. When economies are performing well, consumers buy more gold.

Differences between

Bitcoin versus Gold: Total returns

Gold’s returns in 2017-18 were only 6-7%, compared to Bitcoin’s growth of 1,300%. Bitcoin also outperformed Gold in the years 2019-20, 2021-2022 and 2020-21. Bitcoin, however, has fallen by almost 57% compared with gold, which had a positive annual return of almost 4%.

The Regulations of the United States

Gold is traded and weighed in a flawless system. Gold is difficult to fake or steal, but it’s tightly controlled. In many countries, it is against the law to cross borders with gold without official permission. You should be careful to only buy gold when you can store it safely. You can only purchase gold from registered online gold dealers or brokers when investing in gold.

Bitcoin is impossible to spoof or steal because of its encrypted architecture and decentralized design. With a few notable exceptions, it is usually legal to use Bitcoin across borders. The legislative framework to ensure user safety has not yet been implemented. Also, cryptocurrency anonymity is making regulation more difficult.

Gold is owned by many different people and produced in various ways.

Gold production is not confined to one continent. Gold is held by many people. Gold is held by a variety of people. The U.S. Treasury is known to have the largest gold stock, yet it is only 4% visible gold. Nearly half of the gold is found in jewelry that is worn worldwide by individuals, and more than 20 percent is owned by investors as gold bars or gold coins.

Rare is the possession or use of cryptocurrency.

The average processing power of the network was 80% in 2021. Organizations from five countries held a majority of this. Bitcoin ownership is also very concentrated. Only 2% of Bitcoin owners control 95% all Bitcoins.

Liquidity

Investors who are looking at Bitcoin as a safe haven will be concerned about its liquidity. In general, cryptocurrency investments are liquid, but this is not always the case. At different points, it can fluctuate between being more liquid than other assets or less liquid.

If you want to be able to quickly switch between assets without them losing their value (like Bitcoin), gold is a good choice. Gold is more liquid, so you can move your portfolio around more easily when market conditions change.

You can also use this to your advantage.

Gold has served many purposes in the past. It was used as money, for opulent items, dentistry, electronics and more. This cross-functionality is what allows gold to maintain its value when other assets are declining.

Bitcoin’s usefulness is limited. It is currently only used as an investment in gold and digital currency. The decentralized financial system, however, uses cryptocurrencies to facilitate financial transactions. Bitcoin can be used for borrowing, lending and many other things in this new technology. Bitcoin has many uses, almost as many as gold. It can also be used to lend and borrow.

Expert Opinion

The cryptocurrency market, in contrast to gold, is volatile. The gold market has been around for a long time. It is a liquid asset and investment that consistently produces positive returns. Analysts also claim that digital assets are risky due to their volatility. Bitcoin has seen its price rise and fall to new record lows. Due to this, conservatives are attracted to traditional assets with low risk.

Gold and Bitcoin act differently as investments.

Gold shines when the equity markets are under stress. Bitcoin deviates, however, from the pattern. Bitcoin’s value, for example, more than doubled between November 2021 to May 2022. The price of gold, on the other hand, has remained unchanged.

Gold is less volatile than cryptocurrency, which lowers overall risk and increases long-term returns.

Can Bitcoin outperform gold as an investment?

What is best for you will be determined by your level of risk tolerance, investment approach, capital available, and loss tolerance. Bitcoin is more volatile than gold, making it a much riskier investment.

What is the best period to purchase gold?

Gold is often cited as a good hedge against price increases by many gold enthusiasts. The facts, however, contradict this statement. Gold can be a great hedge in certain cases against commercial disasters, but not against inflation. Gold prices tend to rise during times of crises. This is not always the case during severe inflation. If a recession or monetary crisis is imminent, investing in gold may be the best option. It may make sense to refrain from buying gold if the price of commodities is rising too fast.

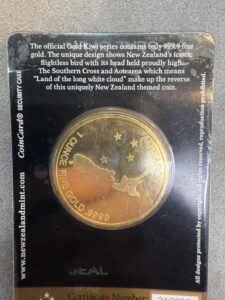

Where can I buy gold bars and coins?

Cash for Gold Company has a long history in gold coins and precious metals. You can buy gold coins or bars on our websites, or you can contact one of our online gold bar dealers. Our global network of gold prices has helped us to serve thousands of satisfied customers. We offer the highest quality gold at the lowest market price, whether you need 1 gram of 10 g. Contact us to learn more about our products and services. We are just a phone call away.